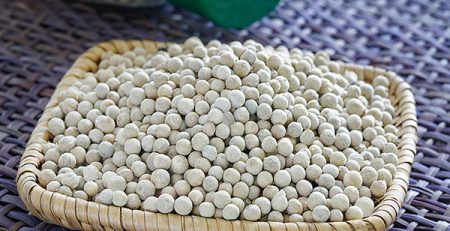

High volatility keeps pepper under uncertainty

For the past few weeks, confusion prevails in the pepper market in view of the uncertainty over the availability of the material in Brazil Indonesia and Vietnam. Prices have been skyrocketing every other trading session with USD 500 and USD 1000 per metric ton increase and in the last six weeks prices have almost doubled in all the major origins except in India where prices are already high though increased but not to the same extent like other origins and currently almost at par with other origins.

Based on the speculative assessments of both bull and bear operators the market is being pushed up and pulled down. Last weekend the bear operators had the upper hand and consequently the prices were pulled down by USD 1000 pmt on Friday but reportedly prices were up again by USD 500 on Saturday making it impossible for processors to end up doing any business with their importers . I have not witnessed this kind of volatility ever since I got into the business in 1981.

Slack demand

Overseas demand has slowed down as the prices showed a dramatic increase in the last six weeks Those who want the material urgently are buying paying the asking prices of sellers while those who can still wait are delaying purchases. Buying activities are expected to pick up from early September as the industrial buyers are expected to become active when the new crop from Brazil and Indonesia enters the market from July and August shipments . The supply situation continues to be unimpressive and Vietnam is the only producer having the material besides Brazil and Indonesia and may be Sri Lanka and India soon if the prices stay at these levels But, the arrivals there have not reportedly shown any significant pick up so far as their crop is slightly delayed

A report from overseas last weekend said “Pepper market remains indecisive. In general the trade is forecasting higher prices, which is largely based on the assumption that supply is still falling short of demand during 2024 ”.

It attributed this argument to “low stocks in Brazil smaller than anticipated India’s latest position as a net importer, Indonesia not being a factor of importance at least until July/August and Vietnam at best having a crop size of 160 K from 2024 crop and carry over of 35K

Please call us for your immediate needs so we can source it back to you

Best Regards

Jojan Malayil

United Spice Co Ltd/ Vietnam

+91 9895 4242 90

91 9895 4242 90

Leave a Reply